As a rule, you want to keep your total debt obligations at or below 30% of your monthly pretax income. The ratio of your monthly debt payments/monthly gross income is also known as your debt/income ratio and is used by lenders and credit bureaus to determine your creditworthiness. Regardless of the quality of your debt, you should aim to keep your total debt payments at or below 30% of your gross income. Therefore, consumer debt is treated as “bad debt” by creditors and drags your credit score down more than “good debt” does. You’re effectively poorer at the end of the transaction than you were at the beginning. Home and school loans are considered “good debt” by creditors and don’t hurt your credit score nearly as much as other types of debt.īorrowing to buy transient or intangible things (think: vacations, fine dining, cars, boats, TVs) usually weakens your financial position in the long run because you pay interest on things that you can’t resell at retail, let alone with interest.

Borrowing to invest in income-generating assets like real estate and career skills can put you in a better financial position in the long term. Second, creditors include the entire mortgage payment (principal and interest) when considering your creditworthiness, so you should use the same debt/income ratio as they do.

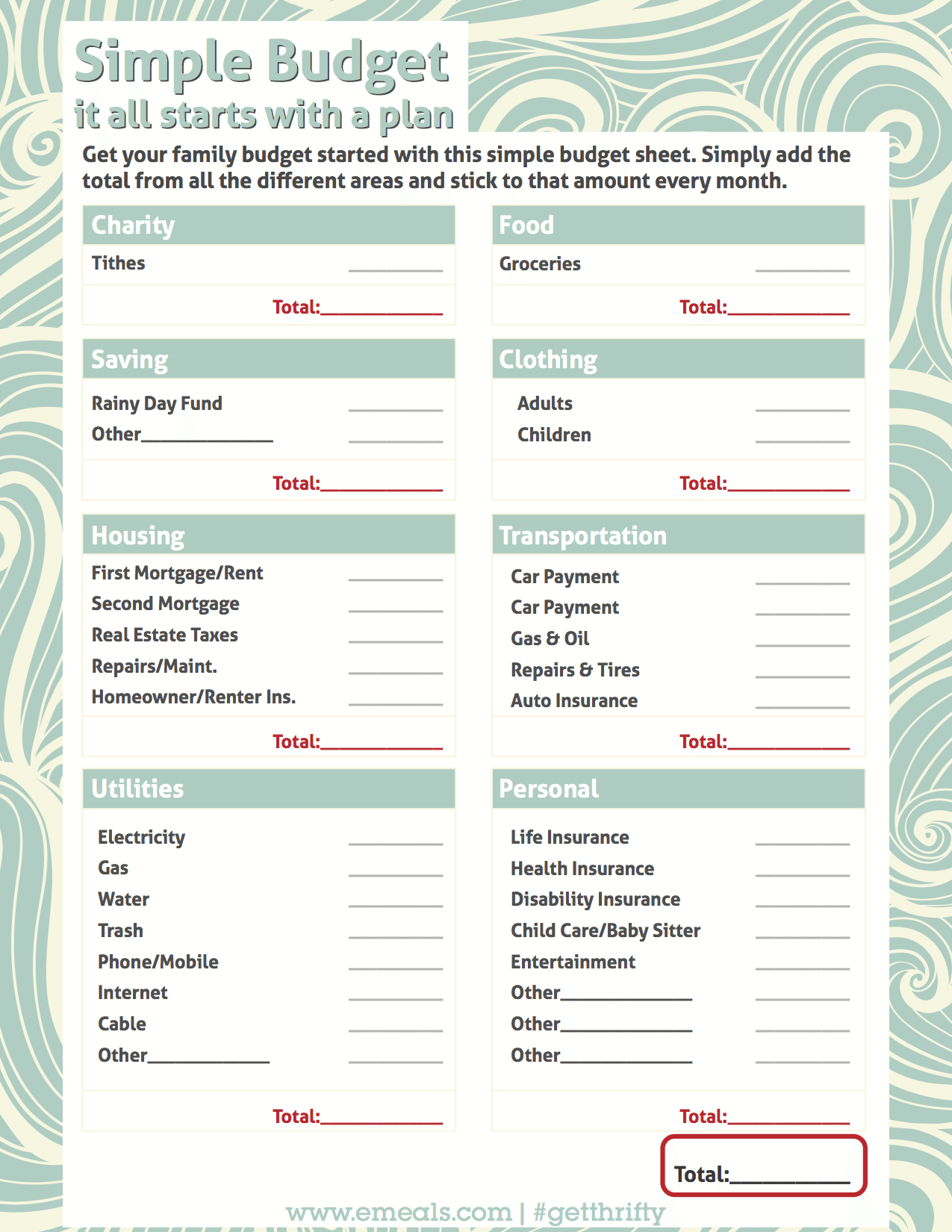

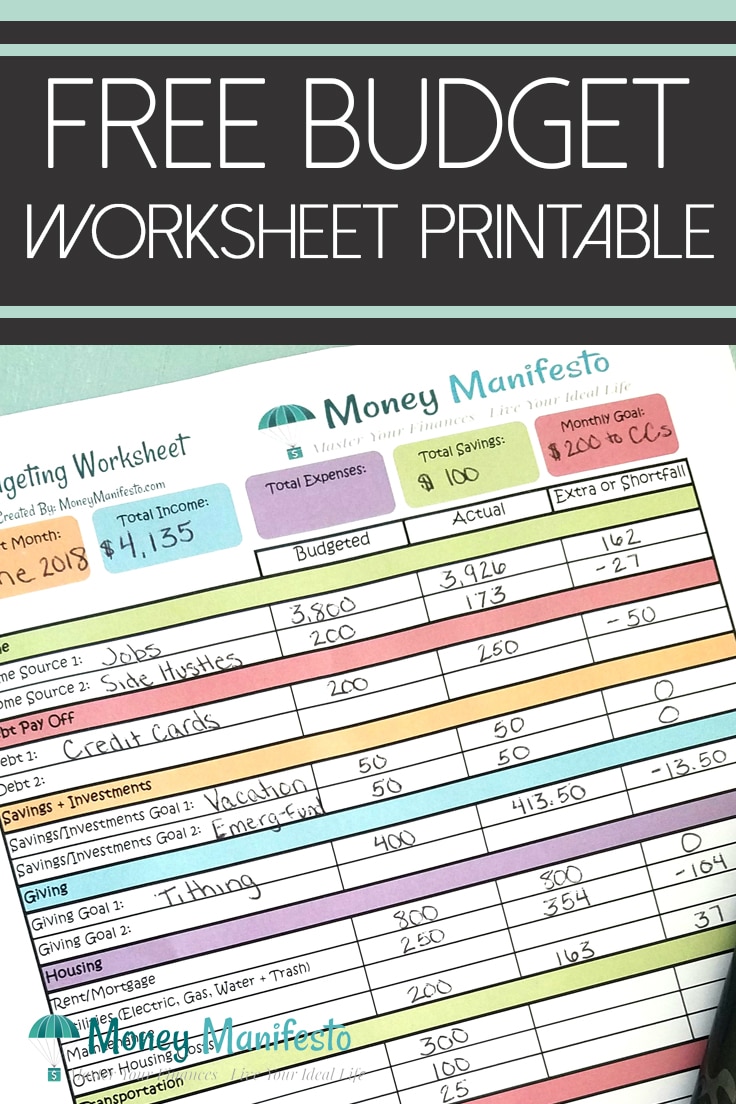

FINANCIAL BUDGET HELP FULL

First, you borrowed the full amount, and the principal you pay is a contractual debt obligation, not a monthly rent payment. Many people want to exclude the principal on mortgages from this calculation, reasoning that this expense is more appropriately assigned to the “present” because it’s a current housing expense. For example, if you earn $6,000/month before taxes and pay $2,000/month toward your mortgage, credit cards, car loan, and student loans, then the past portion of your Golden Ratio would be 2,000/6,000 * 100 = 33.3, meaning that 33% of your income is directed toward paying off past purchases. Then divide this by your gross monthly income and multiply by 100. To calculate the past portion of your Golden Ratio, add up all of your monthly debt payments (principal and interest).

Ten percent of every dollar they earn goes toward debt, 80% is consumed in the present through taxes, groceries, rent, and everything else, and 10% is saved for the future. Someone earning $60,000 per year who saves $500/month (the future) and has debt payments of $500/month (the past) would have a Golden Ratio of 10 | 80 | 10. The Future-Accumulating to create future income.The Present-Funding your current lifestyle.The Past-Paying for things you bought/did in the past.Your Golden Ratio is made up of three numbers, representing the percentage of your gross income that goes to: What’s a Golden Ratio? It’s a formula you can use to figure out how you spend your income. Instead, I’d like to introduce you to the Golden Ratio for personal finance. The answer to these questions as a specific dollar amount isn’t helpful because everyone’s finances are different. What’s realistic to spend on restaurants or transportation in a city like Chicago? How much “should” a person in their 20s be saving?įor her and people in a similar position, I’m going to provide a budgeting tool that skips all the scrutinizing and itemizing and gets right to the heart of what you need to know: Is your cash management healthy? Are you saving enough?

FINANCIAL BUDGET HELP HOW TO

She is off to a great start, but she’s wondering how to prioritize spending and saving now that she’s in a new stage of her financial life. I recently spoke with a woman in her early 20s who has moved out of her parent’s house and is trying to figure out how to steer her financial ship now that she’s the only one behind the wheel. How do you know if you’re saving enough? How much debt is too much? What’s a healthy consumption rate?

0 kommentar(er)

0 kommentar(er)